Rating and Revenue

Planning

So, who pays and how much?

How do you spread council’s rate burden across the community in a way that’s fair and equitable?

What’s the optimal mix of general rates, municipal charges and service rates and charges that’s fair and equitable for all?

The Local Government Act requires councils to prepare a Revenue and Rating Plan by 30 June in the year following elections.

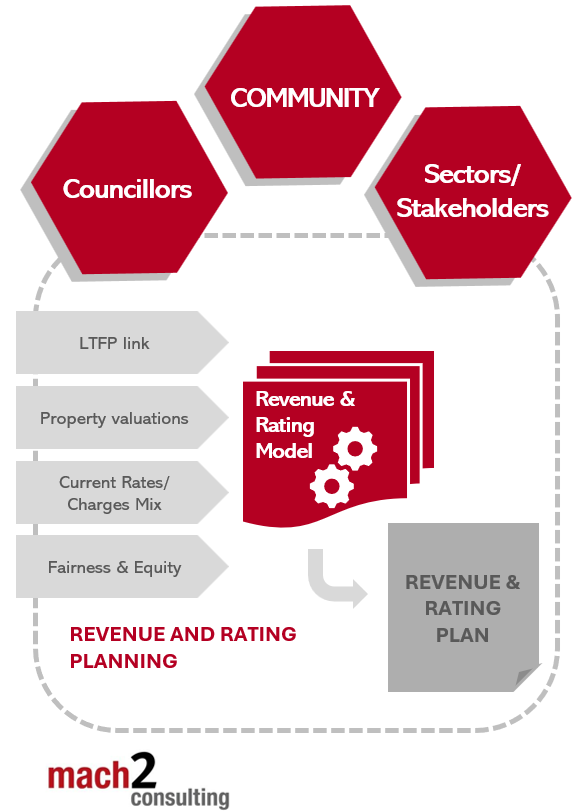

Preparing a Revenue and Rating Plan requires:

- Engagement with the community, sectors and interest groups as well as key decision-makers (councillors/executive).

- A dynamic rates/revenue model capable of reliable multi-scenario development .

- Clarity/links with other organisational planning instruments and Plans (LTFP).

The rates and charges component of the Revenue and Rating Plan should focus on how the rates ‘cake’ is split and spread across the different categories of rateable properties. It should model the potential for differential rates, municipal charge and service rates and charges in the overall mix. Scenarios developed should address overall revenue impact and impacts on rates bills by type and location.